The S&P BSE SME IPO index's performance over the past year paints a compelling picture of the vibrancy and potential of India's small and medium enterprises (SMEs) in the public market. This analysis aims to illuminate why East West Bridge Capital (EWBC) is particularly bullish about the B2B and SME IPO sectors in India, offering insights for potential Limited Partners (LPs) considering investments in this dynamic segment.

Phenomenal Growth in the BSE SME Index

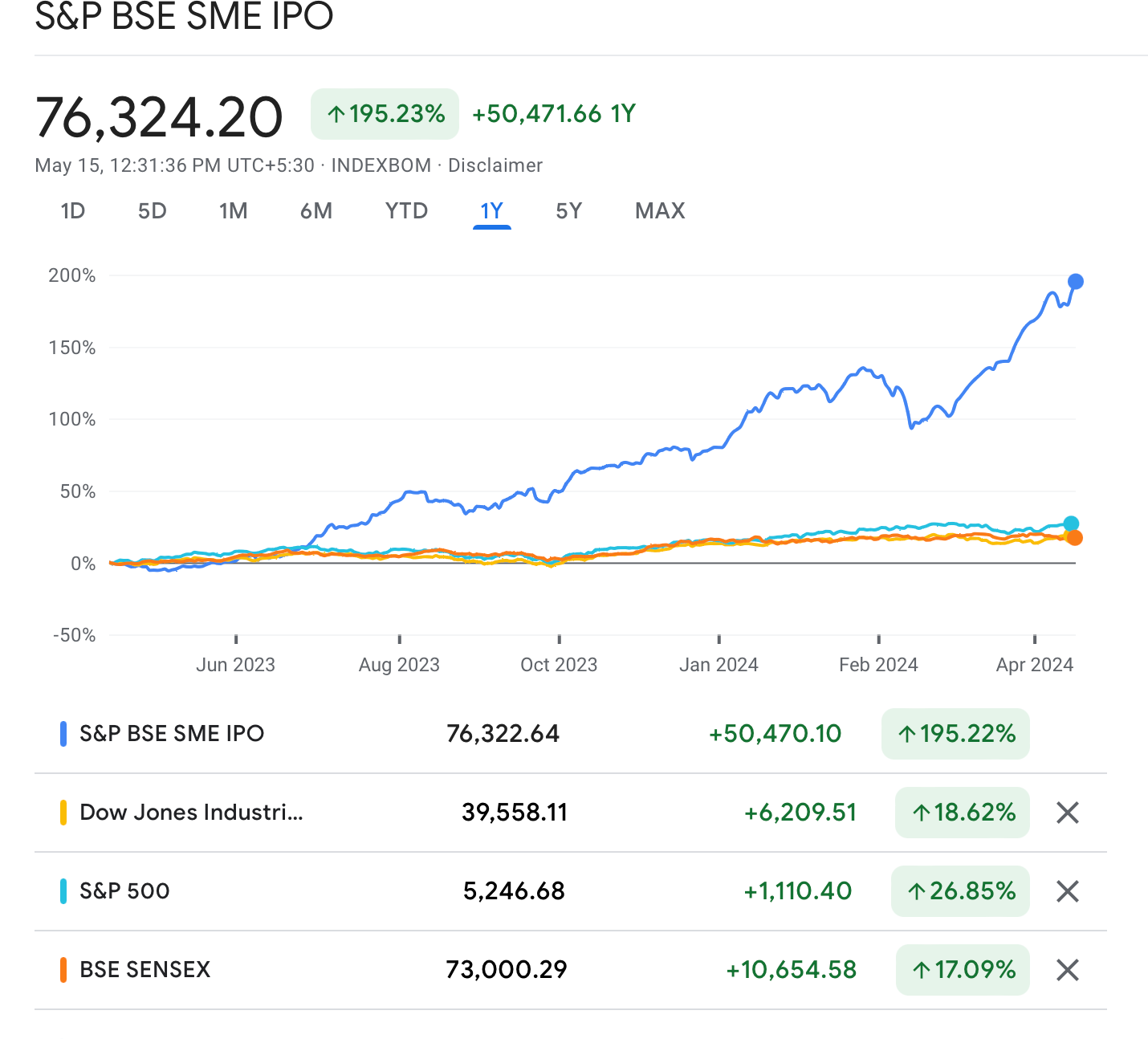

The BSE SME IPO index has seen an unprecedented rise of 195.23% over the past year, significantly outperforming major indices such as the Dow Jones Industrial Average, S&P 500, and the BSE SENSEX. This exceptional growth is a testament to the robust investor confidence and market dynamism within the SME sector, marking it as a hotspot for potential high-yield investments.

Strategic Importance of the SME Sector to India's Economy

Economic Contribution: SMEs are pivotal to India's economic fabric, contributing significantly to employment and GDP. The government's supportive policies and initiatives to simplify capital access for these enterprises underscore their strategic importance.

Market Resilience and Investor Confidence: Despite global economic uncertainties, the BSE SME IPO index's performance demonstrates the sector's resilience and growing investor confidence. This is crucial for LPs looking for stable yet profitable investment avenues.

Rapid Sectoral Growth: The substantial increase in the number of companies listed and capital raised via the BSE SME platform highlights the sector's rapid growth. With over 500 companies listed and significant capital mobilization, the SME sector is on a fast track to becoming a major component of India's market ecosystem.

Detailed Market Dynamics

Listed Companies and Market Capitalization: Currently, there are 316 companies actively listed on the BSE SME platform with a total market capitalization of Rs. 1,58,782.82 crore. This provides a broad market base and diversified investment options for LPs.

Capital Raised and Success Stories: With Rs. 6,580.96 crore raised to date, several companies have successfully leveraged the capital for expansion and growth, with 185 companies graduating to the main board, indicating the potential for substantial returns on investment.

Market Activity Insights: The active trading dynamics with 163 companies traded, and a split between 95 advances and 61 declines, provide a nuanced view of the market's behavior, offering strategic entry points for informed investors.

EWBC's Investment Thesis

EWBC's bullish stance on the B2B and SME IPO market is based on:

Alignment with Growth and Innovation: Investing in sectors that are not only growing rapidly but are also innovating at the edge of technological and business model transformations.

Risk-Adjusted Returns: The impressive performance of the SME index, coupled with strategic government initiatives, presents a favorable risk-adjusted return profile.

Potential for High Impact: Investments in SMEs have the potential to drive significant economic and social impact, aligning with EWBC's goal of fostering sustainable and inclusive economic growth.

Conclusion

The BSE SME platform's current landscape and the SME sector's performance are indicative of the immense potential that these markets hold. EWBC's focus on this segment aligns with our strategy to invest in areas that offer not only financial returns but also contribute to the broader economic and social fabric. For LPs looking to participate in India's growth story, the BSE SME IPO market offers a unique blend of opportunity, diversity, and potential for significant returns, backed by a robust economic rationale and strategic market insights.

This analysis underscores why EWBC remains optimistic about the future of B2B and SME IPO investments in India, positioning it as a key area for potential and current investors looking to capitalize on emerging market dynamics.